Inheriting assets may bring attitude, of pleasure on getting an asset so you can frustration otherwise fret from the controlling the commitments that are included with they. Whether the passed on house is a family group house otherwise an investment house, judge and you can financial points have to be treated. Each step need consideration, from navigating the newest probate process to deciding the best financial solutions.

A typical matter getting beneficiaries is if capable take-out a property equity loan on handed down property. This is just one of several economic possibilities readily available whenever dealing with a hereditary domestic. On this page, we’ll mention the fresh new judge and you will financial a few whenever dealing with inherited assets, assisting you create advised decisions for your upcoming.

Extremely common to feel pleased whenever a person is a recipient out-of property, such as for instance homes and buildings, but at the same time, misunderstandings otherwise stress will get arise overall is even bestowed which have requirements that come with getting the home. Should it be a household household otherwise a good investment, courtroom and you may fiscal activities will likely occur. Every facet of the procedure need to be thought, from checking out the probate way to choosing the right monetary choice.

A new regular concern one to beneficiaries have is when they’re able to score a house equity loan to your passed on possessions; this is certainly among the an easy way to do the fresh new handed down family. On this page, we shall go through the legal effects out of speaing frankly about inherited possessions and also the monetary angles which will make suggestions since you arrange for the long run.

Understanding the Judge Processes

Inheriting house is a legal procedure that could possibly get pose some demands, especially concerning your legal and you will working areas of the need otherwise new house bundle. The first aspect are starting perhaps the property is getting probated; this is exactly an appropriate process which a will is turned out, in addition to deceased’s house was taken care of. Regarding a legitimate tend to, new possessions, that may are real estate, might be given by the fresh new will’s executor. not, if there is zero will, the new court will assign an exec to cope with the method thanks to local heredity actions.

In some cases, the property will have to experience probate, that may capture several months to help you more than a year. Now, the new heirs may be required to make certain expenditures such as insurance rates or other small costs such https://paydayloanalabama.com/helena/ as electric bills. And here a financial solution such as for example a house equity mortgage may come towards play in order to make exchangeability to fund such costs. However, it is important that you first make sure the latest probate procedure was both done or is already with its complex stage in advance of you are able to one decisions about your future of this new passed on assets.

The worst thing to look at ‘s the taxes, and this must be paid back because legal process of probate is more than together with house is transferred to the latest inheritor. In certain elements, fees such as for example inheritance taxation or house fees is relevant. These types of fees was large, just in case they are not repaid, it does produce liens or any other legal issues into the assets. Furthermore, property fees are likely to become borne of the the latest holder. They may bring about of several expenditures, primarily if the property is during the a high property income tax area.

In the event that legal issues was handled, you can consider the newest economic measures online. Passed down assets shall be the best thing to have, however it is expensive to do, especially if you do not propose to live-in they or rent it out instantaneously. A few of the choices you are faced with become whether or not to continue managing the house or perhaps not, whether to sell, or whether to envision providing a property security loan.

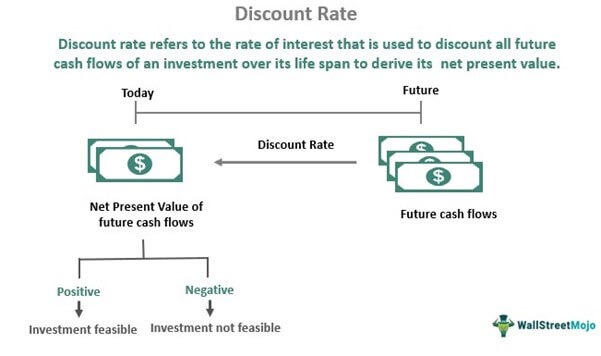

Our home security financing is among the most flexible form of capital to have inherited possessions. These mortgage makes you just take dollars contrary to the worth of the home, that will make you money on the spot and you can which you may use any way you would like. The mortgage you can bring relies on the modern value of the house and you can any existing financial harmony. This can appeal to the owners who wish to retain the assets and need cash a variety of causes, and additionally rehabilitating the property or even settling almost every other expenses associated to the property.

Prior to you take aside a property guarantee mortgage, you must know whether or not you’re good for you. Look at the debt away from providing a loan and also the desire and that is charged finally. For those who have other fund otherwise financial responsibilities, it can be hazardous when planning on taking an alternative mortgage. Simultaneously, should your possessions provides extensive security and you desire to save they for a while, bringing a property guarantee loan can provide you with the fresh new financial freedom you need instead selling the property.

If for example the property is a responsibility and never a living earner, it might be smart to sell. That one enables you to sell the house, pay back the a good estate expense, and also have a good looking number on the proceeds. Selling the house also can totally free you against the burden out-of appointment expenses eg property taxation, maintenance, and insurance. However, selling will be mentally challenging, specially when the house or property try emotionally linked to the holder.

Yet another probable financial service in the event you desire to hold the property and you may likewise you want an income should be to rent this new inherited assets. They could use the property to generate funds to generally meet the brand new annual costs and you may secure a return while you are still possessing they. Although not, the moment that gets a landlord, he could be exposed to more challenges, in addition to tenant management, property management, and income tax towards the local rental income. One should, therefore, take care to evaluate whether the money attained regarding possessions was really worth the effort off handling it.

Completion

When you find yourself inheriting possessions are going to be of good use, it may come with their show from trouble, which means, one should look at the legal and economic ramifications whenever controlling the property. The next step is so you’re able to decode new probate process and people taxes which can be about it. Once checking out the court procedure, you will need to gauge the economic remedies for pick if or not to hold, offer, or make use of the property’s guarantee. Whether you are taking a home guarantee mortgage with the a hereditary assets otherwise offer otherwise rent the home, studies was energy. It can help you in gaining the most out of this unique advantage when you are reducing the risks.

Thomas Oppong

Creator within Alltopstartups and you will writer of Involved in The fresh new Concert Economy. His performs has been featured on Forbes, Organization Insider, Business owner, and you may Inc. Journal.