Why would consumers like to build a property by themselves belongings playing with an FHA You to-Date Personal structure loan (which demands an advance payment out of step 3.5%, minimum) instead of a no-money-down USDA financial?

There are numerous reason a keen FHA mortgage could be the better option according to things, even with a necessary minimum advance payment. One deposit is a lot less than simply some traditional financing require.

USDA framework finance render an advantage to eligible consumers due to its no down-payment criteria. However, a beneficial USDA home loan is actually you desire-established, that money (even build fund) have a family money limit.

USDA loan legislation suggest that in many cases, consumers that assets higher than brand new USDA restrict …may be required to use a portion of those property and that get translate into something different than just a zero-money-out-of-wallet financing otherwise a zero down financial.

FHA mortgage brokers, additionally, have no you desire-based direction. All borrowers which apply need to economically be considered, but there is zero exemption cash advance Fidelis Florida for those who secure a lot of. FHA funds try for all economically licensed borrowers.

FHA One-Time Romantic financing element minimum down-payment regarding 3.5% of your adjusted property value our homethis is the exact same requirement in terms of almost every other FHA pass mortgages.

This new advance payment requisite are high oftentimesalways whenever certain facts such a low-consuming co-borower, or a candidate who not have fico scores high enough so you’re able to qualify for a reduced down payment.

FHA mortgages get one basic limit toward in which property could possibly get be found; you could use only an enthusiastic FHA mortgage buying or make property in the united states or its’ regions.

Exceptions would use in the case of particular ton zones or most other recognized sheer disaster elements that are defined as no approval areas inside the FHA loan statutes. The financial institution, county laws, or any other rules may also have a declare as to what try you’ll be able to to invest in in almost any considering housing marketplace.

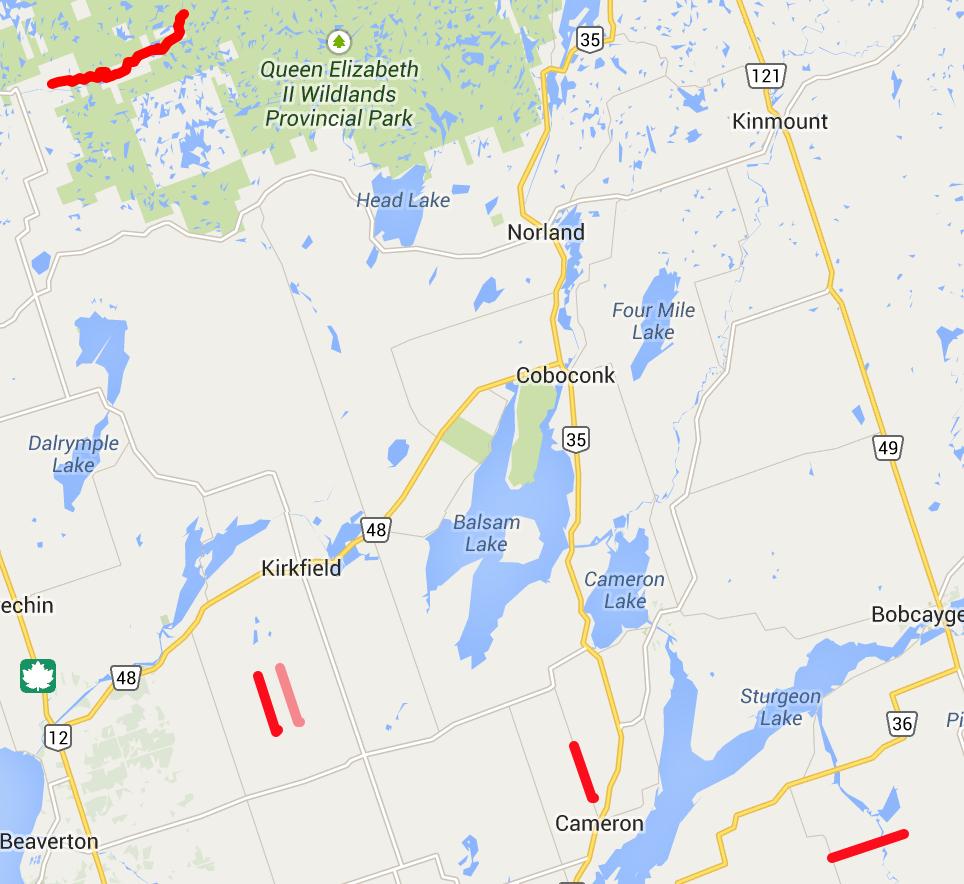

USDA single-home money, on top of that, have more limitations into the spot where the domestic can be foundgenerally this type of fund developed for those who buy in a number of rural areas, although the definition of rural is generally in many cases alot more broadly used.

Ask your mortgage administrator in the FHA home loans and exactly how they can help you get property or refinance a preexisting mortgage.

One-Go out Romantic Funds are for sale to FHA, Va and you can USDA Mortgages. This type of funds in addition to go-by the next labels: step one X Intimate, Single-Romantic Financing otherwise OTC Mortgage. This type of mortgage makes it possible for that loans the purchase of your belongings in addition to the construction of the property. It’s also possible to use house which you individual free and clear otherwise have an existing home loan.

We have complete detailed look on FHA (Federal Homes Government), the brand new Virtual assistant (Service regarding Pros Factors) and the USDA (All of us Agencies regarding Agriculture) One-Time Personal Design mortgage software. We have verbal directly to licensed lenders you to definitely originate this type of domestic financing systems for the majority says and every providers provides provided us the rules due to their affairs. We are able to hook up your which have mortgage loan officers who do work to have loan providers you to definitely understand the device well as well as have consistently offered quality provider. Whenever you are wanting becoming contacted to one licensed structure financial near you, delight posting solutions with the concerns below. Most of the information is treated confidentially.

OneTimeClose brings recommendations and links customers in order to licensed You to-Day Romantic lenders as a way to improve good sense regarding it mortgage product also to assist people located higher quality services. We are not covered endorsing otherwise indicating lenders or mortgage originators and don’t otherwise take advantage of performing this. Customers is shop for home loan characteristics and you will examine the choice in advance of agreeing so you’re able to go ahead.

Please note that investor guidelines for the FHA, VA and USDA One-Time Close Construction Program only allows for single family dwellings (1 unit) and NOT for multi-family units (no duplexes, triplexes or fourplexes). You CANNOT act as your own general contractor (Builder) / not available in all States.

Likewise, this is a limited a number of the next residential property/strengthening appearances that are not greeting around such applications: Equipment Land, Barndominiums, Vacation cabin or Flannel Residential property, Distribution Basket Property, Dome House, Bermed World-Protected Property, Stilt Residential property, Solar (only) or Snap Powered (only) Belongings, Smaller Home, Carriage Home, Connection Hold Systems and you will An excellent-Framed Land.

The current email address so you can authorizes Onetimeclose to fairly share your own suggestions with a home loan design lender licensed in your area to get hold of your.

- Publish your first and you can past title, e-post address, and make contact with number.

- Inform us the town and you can state of one’s advised possessions.

- Let us know the and you will/and/or Co-borrower’s credit profile: Expert (680+), A good (640-679), Fair (620-639) or Poor- (Below 620). 620 is the minimum qualifying credit history for this device.

- Are you otherwise your wife (Co-borrower) eligible experts? When the possibly people meet the requirements veteran’s, off payments only $ount the debt-to-earnings proportion Va allows there are no limit loan quantity according to Va guidance. Very lenders will go to $1,000,000 and you may opinion large mortgage number for the a case by circumstances foundation. Otherwise an eligible seasoned, the new FHA down-payment are step 3.5% up to brand new maximumFHA lending limitfor your county.

Bruce Reichstein has actually invested over thirty years since an experienced FHA and you can Virtual assistant financial home loan banker and underwriter where he was accountable for resource Billions during the government backed mortgage loans. He is the fresh new Managing Editor to have FHANewsblog in which the guy educates homeowners on the specific assistance to have acquiring FHA protected home loans.

Archives

- 2024

- 2023

Regarding FHANewsBlog FHANewsBlog was launched this season because of the seasoned home loan advantages wanting to teach homebuyers regarding the assistance getting FHA covered mortgage money. Prominent FHA subject areas were borrowing from the bank requirements, FHA financing constraints, mortgage insurance fees, settlement costs and many more. The new writers wrote thousands of posts specific to FHA mortgages and also the site has actually considerably improved audience usually and is noted for their FHA Reports and you can Opinions.

FHA Construction Money As opposed to USDA Structure Finance

The latest Va You to-Date Personal are a 30-12 months home loan offered to experienced borrowers. Borrowing recommendations are prepared of the lender, generally speaking having a great 620 minimum credit rating requirements.